При скольки градусах закипает? Независимо от типа используемого прибора в нормальных условиях вода закипает при следующих значениях температуры (в наиболее распространенных единицах измерения): Цельсия, 0С Фаренгейта, 0F Кельвина, К 100 212 373,15...

ВАШ ДОМ

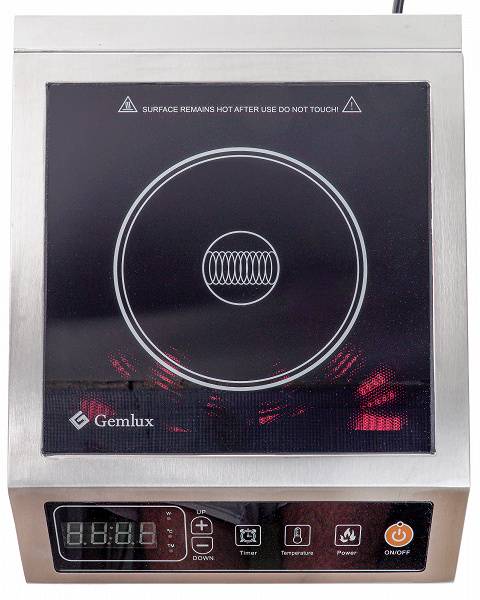

Все про технику, которая наполняет Ваш дом! Бытовая, кухонная, газовая, мелкая и крупная.